Master of Arts in Personal Finance Education

Disclaimer Statement

The Department of Social Sciences and Policy Studies (SSPS) has recently discovered that some organisations claim to guarantee student admission to Master of Arts in Personal Finance Education (MA(PFE)). In response to this, the Department would like to make the following official statement:

1. The MA(PFE) has never authorised any third party to be involved in its application and admission process.

2. All applicants must submit their application via the University’s online system.

3. Shortlisted applicants will undergo the rigorous procedure of academic document verification and admission interview. There is no guarantee of admission as it solely depends on the applicant’s qualification and performance.

Please be careful of any claims of “guaranteeing enrollment”, “proxy recruitment” from any organisations. We encourage applicants to submit their applications directly to the University’s online system (https://www.eduhk.hk/acadprog/online/).

PROGRAMME FEATURES

- It is the first Master of Arts programme in personal financial education in Hong Kong, focusing on both theoretical financial knowledge and workplace application skills to improve participants’ competitiveness in the market.

- Participants will be given opportunities to gain practical and first-hand experience in transferring financial knowledge to individuals and the tools to enable them to be professional financial educators, equipping the skills to operate effectively in the three areas of education, business, and society.

- The demand for financial talents in mainland China and Hong Kong is growing rapidly. Graduates have a wide range of employment prospects, including banking and financial institutions, government agencies, educational institutions, and mass media.

- All subjects are taught in English, in order to strengthen participants’ English proficiency and competitiveness in the international market.

The Institute of Financial Planners of Hong Kong (IFPHK) confirms that Master of Arts in Personal Finance Education [MA(PFE)] graduates are eligible to apply for “Fast-track to Certified Financial Planner (CFP) Certification” - List C candidacy. Under the fast-track arrangement, the MA(PFE) graduates will be exempted from taking the CFP certification education program (courses 1 to 3) and the CFP certification examination (foundation level).

PROGRAMME ENQUIRIES

| Hotline : | (852) 2948 8727 |

| Fax : | (852) 2948 8018 |

| E-mail : | mapfe@eduhk.hk |

| Website : | https://www.eduhk.hk/mapfe |

| In person : | Room D3-1/F-22A, Department of Social Sciences and Policy Studies, The Education University of Hong Kong, 10 Lo Ping Road, Tai Po, New Territories, Hong Kong |

| Follow us on | |

ENTRANCE REQUIREMENTS

- Applicants should normally hold a recognised Bachelor’s degree or other equivalent qualifications.

- Applicants whose entrance qualification is obtained from an institution in a non-English speaking system should normally fulfill one of the following minimum English proficiency requirements:

- Overall score of IELTS 6.0 (academic version) (the test should be taken in test centres and the result should be valid within two years); or

- TOEFL (internet-based test) #:

Score of 80 (for tests taken before 21 January 2026)

Score of 4.0 (for tests taken from 21 January 2026 onwards); or - Band 6 in the College English Test (CET) with a total score of 430 or above (the test result should be valid within two years); or

- Grade C or above in GCSE / GCE OL English; or

- Other equivalent qualifications.

- Shortlisted applicants may be required to attend an interview.

#The test should be taken in test centres, and the result should be valid within two years.

For example, if you are applying for 2026/27 academic year, your IELTS / TOEFL / CET6 test must be obtained on or after 1 January 2024.

TOEFL Home Editions, TOEFL MyBest Score, IELTS Indicator, IELTS Online, IELTS One Skill Retake, Duolingo and National Postgraduate Entrance Examination (全國碩士研究生招生考試) are NOT acceptable.

For details, please visit: https://www.eduhk.hk/acadprog/EnReq(Pg)/

Disclaimer:

The University is committed to uphold the educational quality and standard of the programmes it offers. The University, being funded by the University Grants Committee (UGC), is one of the nine self-accrediting institutions in Hong Kong. In addition, the quality of the educational experience in all programmes offered by the UGC-funded universities is subject to the quality assurance process administered by the Quality Assurance Council of the UGC.

Every effort has been made to ensure the accuracy of the information contained in this website. Changes to any aspects of the programmes may be made from time to time as due to change of circumstances and the University reserves the right to revise any information contained in this website as it deems fit without prior notice. The University accepts no liability for any loss or damage arising from any use or misuse of or reliance on any information contained in this website.

Important Notes for Students from Mainland China on Overseas Credential Evaluation (國(境)外學歷學位認證)

- Students who have fulfilled the programme requirements will be conferred the degree upon the approval of the University's Academic Board. The University bears no responsibility for the evaluation of its degrees outside of Hong Kong. Students are advised to consult with the relevant authority(ies) for the prevailing rules/regulations.

- Individuals who would seek qualification certification in Mainland China after graduation should contact the Chinese Service Centre for Scholarly Exchange (CSCSE) 中國(教育部) 留學服務中心 (https://www.cscse.edu.cn) for updated details.

- The certification in Mainland China is an independent process from the conferral of academic qualification in Hong Kong by the University. For the avoidance of doubt, no warranties are given in respect of individual graduate's qualification certification or recognition in Mainland China or any other professional qualification or license outside Hong Kong.

- CSCSE takes a very prudent approach in evaluating each application, including the students' residential period in Hong Kong during the entire study period. When evaluating graduates' credentials, the full border entry and exit records of individual applicants will be examined.

- Students who would pursue credential recognition should be aware that short stays in Hong Kong during the study period may not fulfil the CSCSE residential requirements, leading to possible uncertainty and risks to their credential recognition.

- Students are seriously advised to consider the above when making personal plans, such as accommodation and travel plans from Hong Kong, etc. and make necessary arrangements where appropriate.

It is the responsibility of the students to be familiar with and comply with the University regulations and guidelines governing the Taught Postgraduate Programmes. Students should refer to the Graduate School website for the General Academic Regulations and the Code of Practice for Taught Postgraduate Programmes for details.

Students should consult with CSCSE if they have any enquiries.

PROGRAMME AIMS

The MA(PFE)’s objectives are to:

- equip participants with professional knowledge in finance and necessary skill sets for investment analysis;

- enable participants to formulate and implement comprehensive personal finance education for individuals with different financial backgrounds and needs in a society of prolific lifestyles;

- focus on necessary financial knowledge in personal finance and the application of knowledge and skills required for effective financial decision-making, financial planning and hence training, education, and knowledge transfer; and

- equip participants to meet their career goals in either the financial services sector or financial-related educational/training sector.

Upon successful completion of the programme, participants should be able to:

- demonstrate solid understanding and a broad spectrum of knowledge and concepts in finance and financial management (PILO1);

- critically evaluate the trend and development of financial and investment markets in a global perspective (PILO2);

- integrate financial knowledge in solving personal financial problems and ethical decision making (PILO3);

- possess high professionalism, creativity and competencies as a financial literacy educator (PILO4); and

- transfer and apply research methods and financial knowledge in the context of professional work. (PILO5).

PROGRAMME STRUCTURE

The programme comprises 24 credit points (cps). Participants normally take one year (full-time mode) or two years (part-time mode) to complete the programme. They need to attend classes (in the same or different semester(s)) which may be scheduled on weekday daytime/evenings, weekends and/or during long holidays at the Tai Po Campus / Tseung Kwan O Study Centre / North Point Study Centre / Kowloon Tong Satellite Study Centre and/or other locations as decided by the University.

PROGRAMME CURRICULUM

Students are required to complete 24 credit points for graduation. The normal study pathway is shown as below:

| Full-time Mode: | |||

|---|---|---|---|

| Year | Semester | Courses | Credit Points (cps) |

| 1 | I | Core: Global Financial Market and Instruments (3 cps) | 12 cps |

| Core: Quantitative Analysis for Financial Studies (3 cps) | |||

| Core: FinTech and Consumer Finance (3 cps) | |||

| Core: Ethical Issues and Decision Making in Personal Finance (3 cps) | |||

| II | Core: Investment Analysis and Risk Management (3 cps) | 9 cps | |

| Core: Comprehensive Practical Financial Planning (3 cps) | |||

| Core: Financial Literacy Education for All Aged Groups (3 cps) | |||

|

*Elective: |

3 cps | ||

| Total Credit Points | 24 cps | ||

*Choose one out of three elective courses

*The offering of elective courses and the quota offered is subject to the Programme’s decision and students enrolment. It may vary in each academic year.

| Part-time Mode: | |||

|---|---|---|---|

| Year | Semester | Courses | Credit Points (cps) |

| 1 | I | Core: Global Financial Market and Instruments (3 cps) | 6 cps |

| Core: Quantitative Analysis for Financial Studies (3 cps) | |||

| II | Core: Investment Analysis and Risk Management (3 cps) | 6 cps | |

| Core: Comprehensive Practical Financial Planning (3 cps) | |||

| 2 | I | Core: FinTech and Consumer Finance (3 cps) | 6 cps |

| Core: Ethical Issues and Decision Making in Personal Finance (3 cps) | |||

| II | Core: Financial Literacy Education for All Aged Groups (3 cps) | 3 cps | |

| *Elective: Contemporary Issues in Personal Finance Education or Internship Programme in Personal Finance Education or Sustainable Finance and ESG Investment |

3 cps | ||

| Total Credit Points | 24 cps | ||

*Choose one out of three elective courses

*The offering of elective courses and the quota offered is subject to the Programme’s decision and students enrolment. It may vary in each academic year.

There are two options for students to complete the 24 credit points for graduation:

1) Students who opt for coursework will need to take 8 courses

| Component | Credit Points (CPs) |

|---|---|

| All 7 core courses and 1 Elective | 24 |

| Total | 24 |

2) Students who have sufficient research competencies, obtained approval, and opt for the Research Project can be exempted from taking the Investment Analysis and Risk Management or Comprehensive Practical Financial Planning and the elective course. Their study path is as follows:

| Component | Credit Points (CPs) |

|---|---|

| 6 core courses | 18 |

| Research Project | 6 |

| Total | 24 |

MEDIUM OF INSTRUCTION

The medium of instruction is English.

Every effort has been made to ensure the accuracy of the information contained in this website. Changes to any aspects of the programmes may be made from time to time as due to change of circumstances and the University reserves the right to revise any information contained in this website as it deems fit without prior notice. The University accepts no liability for any loss or damage arising from any use or misuse of or reliance on any information contained in this website.

| Course Title | Course Code & Outline | |

|---|---|---|

| Master of Arts in Personal Finance Education (One-year Full-time / Two-year Part-time) | Global Financial Market and Instruments | BUS6031 |

| Quantitative Analysis for Financial Studies | BUS6032 | |

| FinTech and Consumer Finance | BUS6033 | |

| Ethical Issues and Decision Making in Personal Finance | BUS6034 | |

| Investment Analysis and Risk Management | BUS6073 | |

| Comprehensive Practical Financial Planning | BUS6074 | |

| Financial Literacy Education for All Aged Groups | BUS6037 |

Elective: BUS6039 Contemporary Issues in Personal Finance Education | BUS6046 Internship Programme in Personal Finance Education | BUS6071 Sustainable Finance and ESG Investment

Research Project: BUS6040 Research Project

Any aspect of the courses and course offerings (including, without limitation, the contents of the course and the manner in which the course is taught) may be subject to change at any time at the sole discretion of the University if necessary. Without limiting the generality of the University’s discretion to revise the courses and course offerings, it is envisaged that changes may be required due to factors including staffing, enrolment levels, logistical arrangements, curriculum changes, and other factors caused by change of circumstances. Tuition fees, once paid, are non-refundable.

TUITION FEE

This programme is offered on a self-financed basis.

- Local Students: HK$140,800 for the whole programme

- Non-local Students: HK$176,000 for the whole programme

(Applicable to the 2026/27 cohort)

ENTRANCE SCHOLARSHIP

Entrance Scholarship is available and awarded on the basis of academic merits with consideration of non-academic achievement.

SCHOLARSHIP & AWARD OPPORTUNITIES

The Master of Arts in Personal Finance Education (MA(PFE)) programme offers a variety of exclusive scholarship and award opportunities to inspire students to pursue excellence in academic, professional development, global engagement, and leadership.

| Scholarship/ Award* | Purpose |

| MA(PFE) Merit Award | To encourage students to achieve an academic excellence. |

| MA(PFE) Green and Sustainable Finance Talent Award | To encourage students to participate the certifications in ESG or Sustainable Finance, i.e. Certified ESG Analyst (CESGA) or Specialist Certificate in Green Finance and Sustainability. |

| MA(PFE) CFP Certification Examination Award | To encourage students to earn the CFP Certification by completing the CFP Certification Examinations. |

| MA(PFE) Summer Exchange Programme Scholarship | To enrich MA(PFE) students’ global learning experience via a prolonged summer programme. |

| MA(PFE) Leadership and Professional Achievement Award | To recognize the achievements of MA(PFE) students beyond academic performance such as students’ exceptional leadership, notable accomplishments in non-academic areas |

*Note: The above information on scholarships and awards is subject to change. Details are made available for enrolled students at the time of application.

(Nov 2025) Pioneer in Financial Literacy Education in China Shared the Insight on “Financial Literacy in the AI Era”

On 13 November 2025, the MA(PFE) Programme invited Professor Song SU, Professor and PhD supervisor at the Business School of Beijing Normal University (BNU), to deliver a seminar on “Financial Literacy in the AI Era”. During the seminar, Professor Su discussed the role of AI in enhancing financial education, the impact of financial literacy on AI application usage, and the challenges of AI in financial literacy. Through dialogue with Professor Su, a pioneer in financial literacy education in China, MA (PFE) students broadened their academic horizons in personal finance and financial education.

(Oct 2025) Measuring Financial Literacy of Retail Investors: An Econometrics Approach

On October 30, 2025, the Master of Arts in Personal Finance Education MA(PFE) Programme hosted an academic seminar titled “Measuring Financial Literacy of Retail Investors.” Professor LI Youwei, Professor of Finance at the University of Hull Business School (UK), was invited as the speaker to share his latest research. His work focuses on constructing financial literacy indicators through the textual analysis of social media data. During the lecture, Professor LI introduced a novel method for measuring retail investors’ financial literacy, developed using this textual analysis approach. This provided MA(PFE) students with fresh perspectives in the fields of financial econometrics and behavioural finance.

(Oct 2025) Understand the Blockchain and DeFi at the Guest Lecture

On October 22, 2025, the Master of Arts in Personal Finance Education [MA(PFE)] Programme hosted a financial workshop titled “Beyond Banking: New Frontiers in Decentralized Finance.” The event featured Professor Eric Chiang, Venture Partner at WAGMI Ventures, as the speaker. He provided an in-depth analysis of the industrial trends and the future prospects of blockchain technology and decentralized finance (DeFi). During the workshop, Professor Eric provided MA(PFE) students with both theoretical and practical industry insights, helping them understand how decentralized finance is progressively driving innovation and development within the financial sector.

(Oct 2025) Understanding the Arab-China Business from a Cultural Perspective

On 31 October 2025, Lord Edwin E. Hitti, President of The Arab Chamber of Commerce & Industry (ArabCham), shared his insights on Arab-China Business with the students. Lord Hitti explored the profound cultural distinctions between the Arab world and China that directly impact business and finance. “For financiers and entrepreneurs, understanding these nuances is not merely cultural appreciation but a strategic commercial imperative.” This session provided key insights into leveraging cultural intelligence to build sustainable and profitable commercial bridges between these influential economic spheres.

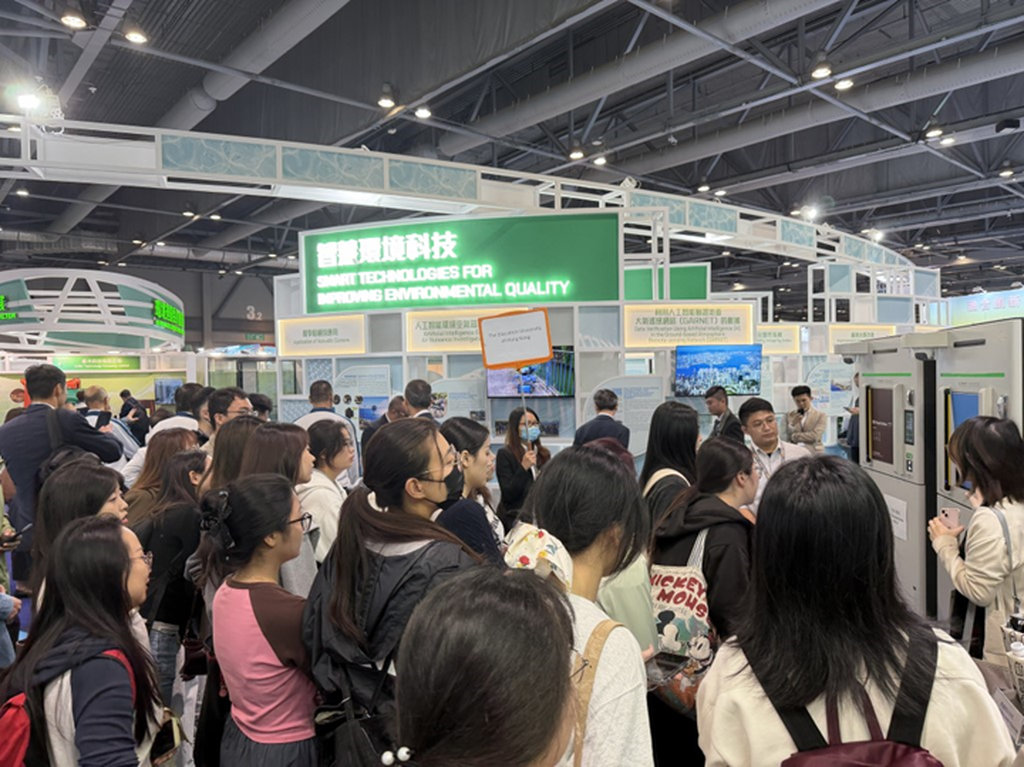

(Oct 2025) Special Visit to the Eco Expo Asia 2025: Exploring the New Trend in Green Finance and Green Technology

On October 28 2025, MA(PFE) Programme led students to a special visit to the Eco Expo Asia 2025. During the Expo, students explored the Green and Sustainable Industries of Hong Kong and the worldwide, including the latest green technologies in energy, green buildings, green finance, and ESG services. Through the guided tour of the Expo and in-depth interactions with exhibitors from the sustainable industries, students realised how to cultivate forward-thinking perspectives in the financial industry during the global move toward carbon neutrality. This Expo also serves as a window for students to understand Hong Kong’s role in promoting global sustainability.

(Oct 2025) Dialogue with Professor Mahesh Harilela: The Family Blueprint: Sustaining Legacy, Advancing Hong Kong

On 22 October 2025, EdUHK held a distinguished lecture entitled ‘Family Blueprint: Sustaining Legacy, Advancing Hong Kong’. The Lecture featured Professor Mahesh Harilela, Family Council Convenor of Harilela Group Ltd., a renowned entrepreneur and philanthropist, who shared his extensive experience in family governance, business succession, and sustainable development. During the lecture, Professor Harilela highlighted the strategic significance of family offices within Hong Kong’s financial ecosystem, noting their importance in attracting international capital and talent. He also shared how family enterprises can preserve tradition while embracing change to foster sustainable social and economic development.

During the interactive session, students from Bachelor of Arts (Honours) in Personal Finance and Master of Arts in Personal Finance Education programmes actively engaged with Professor Harilela. They discussed the future of family offices in Hong Kong and explored career pathways in the wealth management profession. The vibrant atmosphere reflected the strong interest in the topic and the value of direct dialogue with industry leaders.

(Oct 2025) Trends and Career Opportunities in ESG and Green Finance: Hong Kong Insight from Financial Elite

Mr Paul Pong, Founder and CEO of The Institute of ESG & Benchmark (IESGB), shared insights on the Environmental, Social and Governance (ESG) practices in Hong Kong, and discussed the historical development and future vision of the sustainable disclosure pathway. Moreover, Mr Paul Pong engaged students in career development in the ESG industry and explained the importance of achieving Certified ESG Professional (CESGP) for career advancement.

(Oct 2025) Guangzhou Institute of GBA Experts Share Trends and Prospects of Science and Technology Innovation Investment in the GBA

On October 15, 2025, the Programme invited Dr. Jiang Han, a researcher from the Guangzhou Institute of GBA, to conduct a financial research seminar. Dr. Jiang introduced the development progress of the GBA to students. Combined with Think Tank, she analysed the bottlenecks and challenges of the GBA in technological innovation and industrial development, and discussed the implementation pathways and effectiveness of science and technology policies in upgrading industries. Additionally, she shared methodologies and techniques for drafting policy analysis reports. During the seminar, students recognised the core research competency of Tink Tank, which means transforming complex policy issues into clear, implementable policy suggestions.

(Sept 2025) IFPHK launches Financial Planning Youth Elite Program to support MA(PFE) students’ professional development in financial planning

On 18 September 2025, The Institute of Financial Planners of Hong Kong (IFPHK) delivered a workshop on “Wealth Management Industry and Career Paths for Financial Planners” for the students from the Personal Finance programmes. During the workshop, Dr Paris Yeung, CEO of IFPHK, explored the growing demand for financial planners and career opportunities in wealth management with the students. Meanwhile, the workshop also introduces the exclusive Financial Planning Young Elite Program for MA(PFE) students, which is a customised scheme launched by IFPHK to support MA(PFE) students’ professional success in financial planning and financial services.

(April 2025) EdUHK Held an International Symposium on Personal Finance

The Symposium gathered distinguished scholars and practitioners from leading institutions worldwide. This event explored cutting-edge research and innovative practices across key areas including financial literacy, behavioral finance, fintech applications, retirement planning, and inclusive policy solutions. (The Symposium was supported by the Jiangsu-Hong Kong-Macao University Alliance.)

(Mar 2025) EdUHK Alumni Day 2025: "Financial Champions" Booth

Students from the Personal Finance Programme at The Education University of Hong Kong leveraged their knowledge in financial education and wealth management to organize an interactive financial literacy booth. Through engaging activities such as mini-games and informative displays of practical financial tips, they effectively promoted the seven core competencies outlined in the “Hong Kong Financial Competency Framework”, including maintaining balanced budgets, practicing sensible savings, making sound investments, understanding investor protection and fraud prevention, as well as being aware of consumer rights and responsibilities.

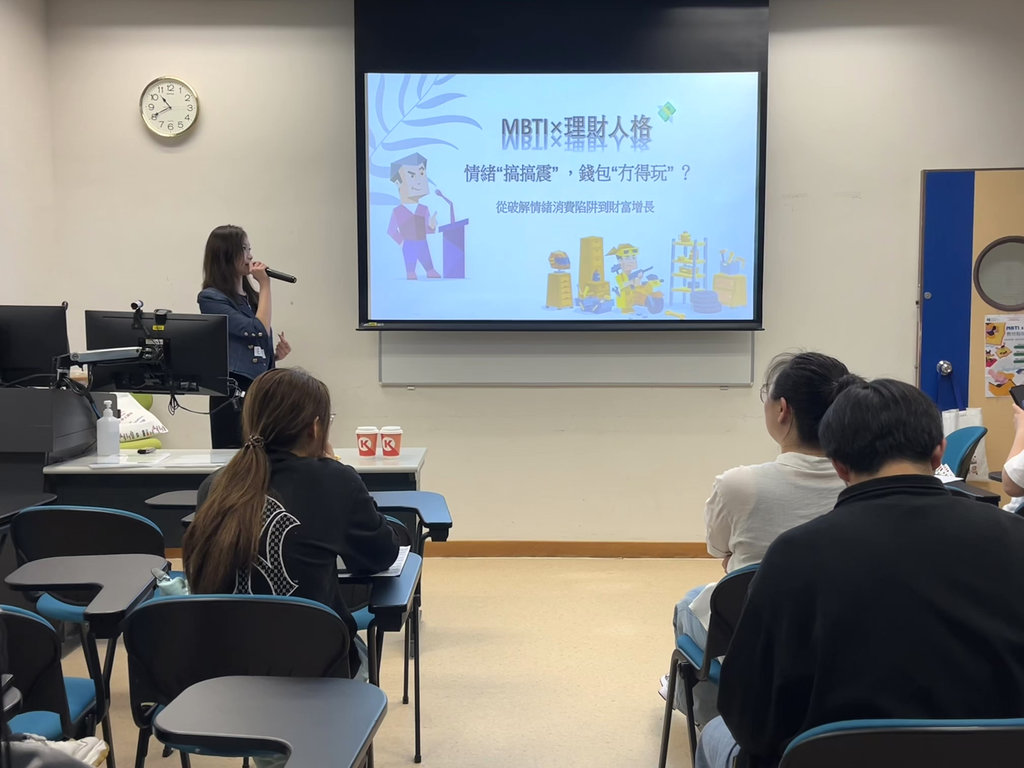

(Mar-Apr 2025) Personal Finance Programme’s Students Organize Campus Financial Literacy Workshop Series

The student teams from EdUHK's Personal Finance Programme successfully organized a Campus Financial Literacy Workshop Series. Serving as keynote speakers, the students shared essential financial knowledge with their peers, contributing to the enhancement of financial literacy across the University.

The workshop series covered a diverse range of topics, including:

• Web 3.0 Investments

• Compound Interest Calculations

• MBTI-Based Financial Personality Analysis

• Economic Principles in Empresses in the Palace

These workshops provided participants with practical financial knowledge and actionable skills.

(Feb 2025) Personal Finance Programme Students Attended The 17th HKIB Outstanding Financial Management Planners (OFMP) Awards - Presentation Ceremony & Gala Dinner

Invited by The Hong Kong Institute of Bankers (HKIB), Personal Finance students attended The 17th HKIB Outstanding Financial Management Planners (OFMP) Awards - Presentation Ceremony & Gala Dinner. This event provided students with a unique opportunity to immerse themselves in the banking industry, particularly in the wealth management and financial planning sectors. It also offered invaluable exposure and networking opportunities which are essential for students’ future career development in the financial sector.

(Feb 2025) "Finance × Wealth Management × Personal Finance" Alumni Career Development Sharing Session

Personal Finance Programme at The Education University of Hong Kong (EdUHK) hosted the "Finance × Wealth Management × Personal Finance" Alumni Career Development Sharing Session in February 2025. Alumni representatives shared their career development experiences and professional growth insights across various fields.

The alumni speakers came from diverse sectors, including private equity investment, banking and financial services, academic research, and higher education. This event actively fostered "alumni-student" connections, expanded EdUHK's professional network in personal finance, and leveraged alumni career development resources.

(Jan 2025) Student Team from Personal Finance Programme Wins Bronze Award in Hong Kong's "Personal Finance Ambassador Programme 2024/25"

The student team "No to Scams" from the Personal Finance Programme won the Bronze Award in the Hong Kong "Personal Finance Ambassador Programme 2024/25." To date, the student teams have won awards for four consecutive years in the "Personal Finance Ambassador Programme", becoming proactive promoters of financial literacy on the EdUHK campus.

(Oct 2024 - Apr 2025) EdUHK Personal Finance Programme Collaborates with HKFWS to Safeguard Elderly Financial Well-being

The Personal Finance programme has strengthened its collaboration with the Hong Kong Family Welfare Society (HKFWS), mobilizing students to deliver financial literacy volunteer services in Hong Kong communities by participating in the 'Wealth Intelligence for Smart Elders Course' under the Elder Academy Scheme*. The student volunteers served as financial education assistants for HKFWS, providing tutoring to the elderly on how to use digital tools for personal finance. For instance, they guided seniors on how to utilize price-comparison mobile apps effectively.

*The scheme is implemented by HKFWS's Financial Education Centre.

(Sep 2024) Vice Chairman of Institute of Financial Planners Hong Kong Shares Insights on Wealth Management and Financial Planning Career Development in Greater Bay Area

Dr. Keith Yu, Vice President (Development) of the Institute of Financial Planners of Hong Kong, shared the latest developments in the wealth management industry in the Greater Bay Area and the career opportunities for Certified Financial Planners (CFP) with students enrolled in the personal finance programme at The Education University of Hong Kong.

(Sep 2024) Hong Kong Institute of Bankers Shares Insights on Green and Sustainable Finance in the Banking Sector

The Personal Finance programme invited Mr. Kenneth YU from the Hong Kong Institute of Bankers to share green and sustainable finance in the banking industry and exchange views with students on career development in the banking and green finance sectors in Hong Kong.

(Sep 2024) Hang Seng Bank Hong Kong Shares Insights on Wealth Management in Hong Kong's Banking Sector

Hang Seng Bank Limited was invited by the Personal Finance Programme of The Education University of Hong Kong (EdUHK) to share insights with students on wealth management in Hong Kong's banking industry.

During the sharing session, students from the Personal Finance Programme engaged in in-depth dialogue with the Hang Seng Bank team on topics such as Hong Kong's banking sector, wealth management, cross-border financial planning, and career development in the financial industry—particularly in banking.

(Sep 2024) Witness the Charms of a Financial Hub Through Financial Education Immersion: Personal Finance Programme Field Visit

The Personal Finance programme organized a series of engaging field trips, helping students gain deeper insights into Hong Kong's financial and commercial development. The students visited the IFEC Financial Education Hub, The Mills in Tsuen Wan, Hong Kong Monetary Authority (HKMA) Information Centre and some financial landscapes in Central.

Past activities:

2023/24

2022/23

2021/22

CAREER PROSPECTS

Graduates are expected to pursue a career in financial services, including banking, securities, credit management, and private equity. The curriculums will also equip the participants for entering some trending financial fields such as private wealth management, family office, fintech, green and sustainable finance, ESG consulting, etc.

Graduates with strong research capacity could also pursue further studies or academic careers in finance or business studies.

PROFESSIONAL RECOGNITION

Eligible MA(PFE) graduates are able to apply for modular exemptions or partial exemptions when attending specific financial certifications in Hong Kong, such as:

| Certifying Institution | Certification | Exemption Summary |

|---|---|---|

| The Institute of Financial Planners of Hong Kong (IFPHK) | Certified Financial Planner (CFP) |

|

| The Hong Kong Institute of Bankers (HKIB) | Certified Banker (Stage I & Stage II) |

Modular exemption from:

|

| Enhanced Competency Framework on Fintech (ECF-FinTech) | Modular exemption from Module 2 Banking and Risk Essentials. | |

| Enhanced Competency Framework on Retail Wealth Management (ECF-RWM) | Modular exemption from Module 2 Investment Planning. | |

| Institute of Financial Technologists of Asia (IFTA) | Certified Financial Technologist (CFT) | Eligible for the exemptions of Level 1 of CFT Programme. |

Prof YU Wai Mui Christina, Dr TAN Weiqiang, EdUHK researchers achieve accolades in diverse fields, China Daily (4 Dec 2024)

https://www.chinadailyhk.com/hk/article/599342

Prof YU Wai Mui Christina, Professor Christina Yu on HKJC's financial literacy programme, RTHK (21 Nov 2024)

https://www.rthk.hk/radio/radio3/programme/backchat/episode/989132

譚偉強,《提升基層金融素養 推動共同富裕》,刊於《文匯報》,2024年6月15日。

https://www.wenweipo.com/a/202406/15/AP666ca396e4b05df3a51f7909.html

譚偉強、麥萃才,《增強理財知識 做好退休打算》,刊於《文匯報》,2024年6月7日。

https://www.wenweipo.com/a/202406/07/AP66621855e4b0a7ef3f0436a1.html

譚偉強,《打造國際人才交流高端平台》,刊於《文匯報》,2024年5月27日。

https://www.wenweipo.com/a/202405/27/AP66539778e4b0bd97947372c9.html

譚偉強,《家族辦公室專才培養宜提速》,刊於《文匯報》,2024年4月25日。

https://www.wenweipo.com/a/202404/25/AP66296739e4b01def1fdfece1.html

譚偉強,《教基層學用手機支付 縮小數字鴻溝》,刊於《文匯報》,2024年4月9日。

https://www.wenweipo.com/a/202404/09/AP66144f65e4b009ba85365621.html

教大碩士結合金融和理財教育元素 畢業生運用所學 助人自助出路廣

(明報JUMP, 24 Jan 2024)

https://jump.mingpao.com/career-news/edu-career-supplement-2024/%e6%95%99%e5%a4%a7%e7%a2%a9%e5%a3%ab%e7%b5%90%e5%90%88%e9%87%91%e8%9e%8d%e5%92%8c%e7%90%86%e8%b2%a1%e6%95%99%e8%82%b2%e5%85%83%e7%b4%a0-%e7%95%a2%e6%a5%ad%e7%94%9f%e9%81%8b%e7%94%a8%e6%89%80%e5%ad%b8/

譚偉強、翁明宇,《公社科應介紹內地與本港經濟發展》,刊於《明報》,2023年2月1日。

https://news.mingpao.com/pns/%E8%A7%80%E9%BB%9E/article/20230201/s00012/1675183183696/

譚偉強,《擺脫跨代貧窮 需「學」「研」深度參與》,刊於《明報》,2022年11月17日。

https://news.mingpao.com/pns/%E8%A7%80%E9%BB%9E/article/20221117/s00012/1668618522740/

Learn to be a money sage

(英文虎報 The Standard, 26 Jan 2021)

https://www.thestandard.com.hk/section-news/fc/4/226921/

大學生「碌」卡是精明還是會惹上一身債?

(信報財經新聞, 朱文英博士, 21 Oct 2020)

https://www1.hkej.com/dailynews/culture/article/2610991/

教育小朋友理財 延遲滿足換取更大獎勵

(信報財經新聞, 朱文英博士, 15 Sept 2020)

https://www1.hkej.com/dailynews/culture/article/2581695/

教大明年首辦理財教育碩士

(星島日報, 3 Sept 2020)

https://std.stheadline.com/daily/article/2273209/

教大明年辦理財碩士課 校長張仁良:樂意客串

(明報, 3 Sept 2020)

https://news.mingpao.com/pns/%E6%95%99%E8%82%B2/article/20200903/s00011/1599070176386/

【中環解密】教大首辦理財碩士課程 張仁良或客串

(信報財經新聞, 3 Sept 2020) https://hk.news.yahoo.com/%E4%B8%AD%E7%92%B0%E8%A7%A3%E5%AF%86-%E6%95%99%E5%A4%A7%E9%A6%96%E8%BE%A6%E7%90%86%E8%B2%A1%E7%A2%A9%E5%A3%AB%E8%AA%B2%E7%A8%8B-%E5%BC%B5%E4%BB%81%E8%89%AF%E6%88%96%E5%AE%A2%E4%B8%B2-193100407.html

教大明年開辦個人理財教育碩士課程 校長張仁良或客串上陣授課

(hket.com, 2 Sept 2020)

https://topick.hket.com/article/2742209

講求事實數據的理財教育

(信報財經新聞, 姚偉梅教授, 8 Jun 2019)

https://www1.hkej.com/dailynews/culture/article/2157737/